What is a 1099?

A 1099 is a tax form used to report income other than wages or salaries. This includes payments made to independent contractors, freelancers, or others who are not employees.

Who Should Receive a 1099?

Some common examples when you might receive a 1099 include:

- Producers who receive royalties from their music may be issued a 1099-MISC for amounts over $10.

- If you sell merchandise through third-party platforms like Etsy, Shopify, or a similar service, you might receive a 1099-K if your gross sales exceed the annual threshold (e.g., $5,000 for 2024).

- If you’re a DJ hired to play at a festival, the promoter may issue a 1099-NEC if they paid you $600 or more.

Who Should Issue a 1099?

You must send a 1099 form if you paid someone more than $600 for things like services, rent, prizes, or other types of income. Different types of 1099 forms have their own rules for when they need to be sent, so it’s important to know the limits for each one.

What to Do If You Don’t Get All Your 1099s?

Even if you don’t receive all your 1099s, you’re responsible for reporting all income. Contact the company that paid you to request missing forms. If needed, you can file for an extension with the IRS. Failure to report income could result in the IRS sending you a letter or bill for unpaid taxes.

Common 1099 Types for Musicians:

There are over 20 types of 1099s, the most common ones for musicians are 1099-NEC, 1099-MISC, and 1099-K.

- 1099-NEC (Nonemployee Compensation): If you’ve earned $600 or more from a single client for your artistic services, they are required to issue you this form. If you work for more than one payor, you’ll receive a 1099-NEC tax form from each company.

- 1099-MISC (Miscellaneous Income): t is used to report different types of income that aren’t from regular jobs or freelance work. It includes things like music royalties, rental income (like studio or equipment rentals), and sponsorship payments not tied to a contract. You’ll usually get this form if you were paid $600 or more during the year, except for royalties, which are reported if they’re over $10.

- 1099-K (Payment Card and Third-Party Network Transactions): You’ll receive a 1099-K if you received more than $5,000 in 2024 payments for goods and services through a third-party payment system such as Venmo, PayPal, or Square. The form reports the gross amount of all transactions processed on your behalf.

Tips:

- Check for Errors: Review your 1099 to make sure all the information is correct. If you find a mistake, tell the person or company who sent it to you right away. If they already sent the wrong form to the IRS, ask them to send a corrected one. There’s a special box on the 1099 to show it’s a correction, so the IRS doesn’t accidentally count both amounts.

- Wrong Address? If your 1099 has the wrong address, don’t worry too much—it doesn’t affect your taxes since the IRS cares about the income information, not the address. Update your address with the IRS using Form 8822, so you receive any future tax correspondence.

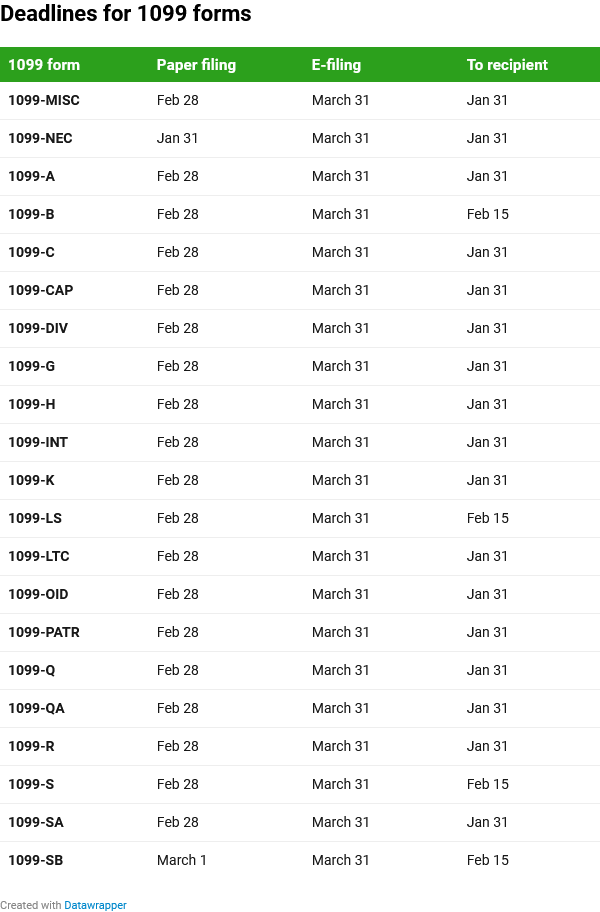

Key Deadlines for 2024 Tax Filing

Note: This information applies to the 2024 tax year and the associated filing deadlines.