Taxes For International Artists: Complete Guide To Non-Resident Alien Tax Filing

Let’s simplify the tax process for international artists working in the U.S. and equip you with the essential knowledge to navigate your tax obligations with confidence.

Understanding your tax obligations is not just a legal requirement for an international artist venturing into the United States market—it’s a crucial step toward financial success and peace of mind. While the U.S. tax system can be complex, fulfilling these obligations is essential to avoid penalties.

When a foreign artist fails to file a U.S. tax return, any organization making payments through a U.S. management company or booking agency could share liability—this includes the organization, agency, management company, and the artist themselves.

Key Takeaways:

- As an international artist working in the U.S., you may be subject to several types of taxes. Understanding each type is crucial for proper compliance and financial planning

- Knowledge of deductions specific to artists can help you minimize your tax burden, effectively increasing your net income.

- Tax treaties between the U.S. and various countries can significantly reduce or eliminate withholding taxes on certain types of income.

Tired of tax headaches? Let us help you transform your financial future.

Understanding the U.S. Tax System for International Artists

The United States has tax treaties with numerous foreign countries, which can affect how international artists are taxed on income earned within the U.S. Residents of foreign countries may be eligible for reduced tax rates or exemptions on certain types of income received from U.S. sources.

However, if a treaty doesn’t cover a particular kind of income or if there is no treaty between the artist’s country and the U.S., standard tax rates and rules apply.

Who needs to file?

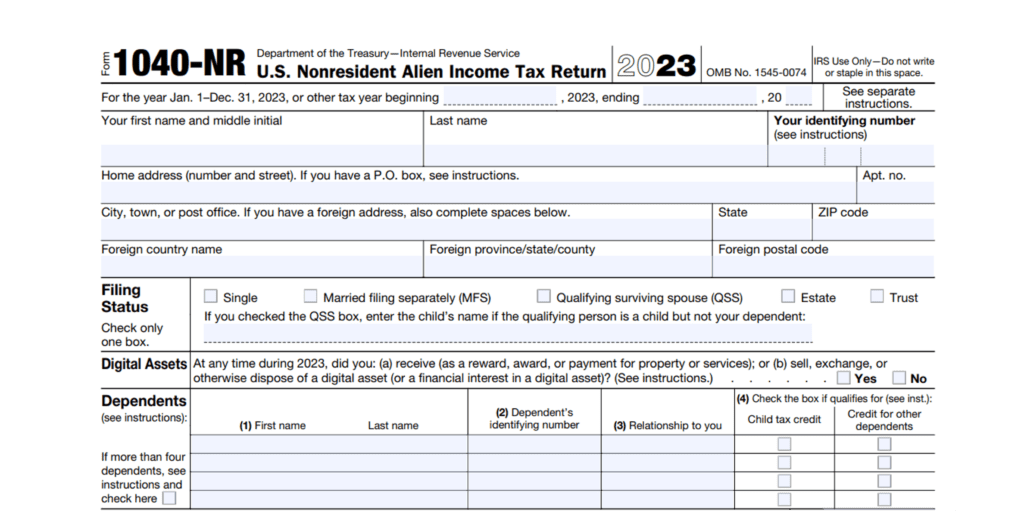

Foreign individual artists who receive compensation for personal services performed in the U.S. are generally required to file an income tax return to report their U.S. income. This requirement applies even if the income is exempt from U.S. income tax under a treaty. Non-residents typically use Form 1040NR to fulfill this requirement.

To ensure proper tax withholding and treaty benefits, foreign artists often provide promoters or payers with a completed Form W-8BEN, which certifies their foreign status and any applicable treaty benefits.

Tax Basics for International Artists in the U.S.

Here’s an overview of the main types of U.S. income for international artists and how they’re taxed:

1. Earned Income

Royalties and licensing fees: Income from U.S. streaming, licensing, or other royalties is usually subject to U.S. taxes.

Performance fees: Income from live shows, appearances, or per diems are typically taxable, and withholding may apply.

2. Investment Income

Interest, Dividends, and Capital Gains: Income from investments like U.S. stocks or interest earned from U.S. bank accounts.

3. Other Income

Grants and awards: Grants, awards, and art sales in the U.S. are often taxable.

Tip: Check to see if there’s a tax treaty between the U.S. and your home country for exemptions or reduced rates on certain income types.

Tax Residency and Filing Requirements

Your tax obligations in the U.S. largely depend on your tax residency status. The IRS categorizes foreign individuals into two groups:

1. Non-resident Aliens

Generally, you’re considered a non-resident alien if you do not pass the Substantial Presence Test or the Green Card Test. As a non-resident alien, you’ll file Form 1040NR reporting only your U.S. source income.

2. Resident Aliens

If you pass the Substantial Presence Test or hold a green card, you’ll file as a resident using Form 1040 and report worldwide income.

Substantial Presence Test: What is it?

The Substantial Presence Test is based on your physical presence in the U.S. over a three-year period. You meet this test if:

- You were present in the U.S. for at least 31 days during the current year, AND

- The sum of the following equals or exceeds 183 days:

- All days you were present in the current year, plus

- 1/3 of the days you were present in the first year before the current year, plus

- 1/6 of the days you were present in the second year before the current year.

Example: Let’s say you’re an artist who spent the following days in the U.S.:

- 2024 (current year): 120 days

- 2023: 90 days

- 2022: 60 days

Calculation: 120 + (90 ÷ 3) + (60 ÷ 6) = 120 + 30 + 10 = 160 days

In this case, you would not meet the Substantial Presence Test for 2024 because the total (160) is less than 183 days.

Unlock hidden savings and streamline your taxes—we are just a click away.

Deductions for International Artists

As an international artist, understanding deductions can significantly reduce your tax liability. Here’s a detailed look at what you might be able to claim:

Common Deductible Expenses

1. Travel costs:

- Airfare, car rental, train tickets, or other transportation costs related to your artistic work

- Accommodation expenses for work-related trips

- Meals during business travel (usually 50% deductible)

- Local transportation (taxis, Ubers, public transit) during work trips

- Insurance

Example: If you travel from London to perform at a venue in N.Y., you can deduct the cost of your hotel stay, flight, Uber rides and 50% of your meal expenses during the trip.

2. Equipment and supplies:

- Artist equipment (sample packs, gear, etc.)

- Tools and equipment (cameras, editing software, musical instruments)

- Computers and technology used primarily for your business

Example: If you’re a digital artist and purchase a new graphics tablet for $1,000, this would be a deductible expense.

3. Marketing and promotion:

- Website development and hosting fees

- Advertising costs (Facebook, Instagram, flyers)

- Printing costs for business cards, flyers, or catalogs

- Fees for art fairs or exhibitions

Example: If you run a promotional campaign on Instagram to advertise your upcoming shows, spending $300 on targeted ads to reach your audience. Since the campaign directly promotes your business, the full $300 is deductible.

4. Professional development:

- Workshops and seminars related to your art

- Art books and subscriptions to professional publications

- Membership fees for professional art organizations

Example: The cost of a $500 masterclass in advanced painting techniques would be deductible.

5. Legal and professional fees:

- Fees paid to attorneys for contract reviews

- Accounting and bookkeeping expenses

- Fees paid to agents or managers

Example: If you pay $5,000 to your booking agent who booked your U.S. shows, this is a deductible expense.

Experience peace of mind with our seasoned tax professionals—contact us today!

Record Keeping and Documentation

Keeping accurate records is essential for claiming deductions. Here are some tips:

- Save receipts for all business-related expenses, no matter how small.

- Have a dedicated account for your business to easily track income and expenses.

- Keep a portfolio of your work and records of sales or performances.

- Consider using accounting software like QuickBooks to streamline your bookkeeping.

- Keep all tax-related documents for at least three years after filing your return.

Parting Thoughts

Navigating the complex U.S. tax system as an international artist can be challenging. This is where ICONAC, a specialized Business Management firm with experts in taxes for international artists, can provide invaluable assistance.

Benefits of Collaborating with Us

Expertise in artist-specific tax issues

ICONAC’s professionals understand the unique tax situations that international artists face, including:

- Reporting income from multiple countries

- Collecting and amending 1042s from U.S. vendors

- Maximizing deductions specific to artists

Compliance assurance: We help ensure that you’re meeting all U.S. tax obligations, reducing the risk of penalties or audits.

Tax planning and strategy: We can develop a tax strategy that will minimize your liability while ensuring compliance.

Time-saving: By handling complex tax matters, we allow you to focus on your art rather than paperwork.

Take proactive steps in managing your taxes. Consider reaching out to ICONAC, as we specialize in helping international artists and can offer personalized advice to fit your unique situation, saving you both money and stress.