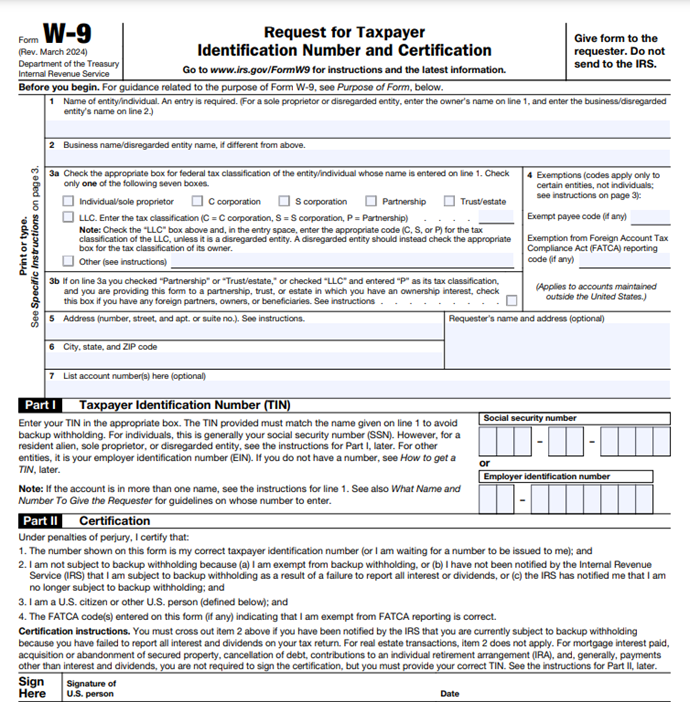

What Is A W-9 Form: Who Needs It And How To Fill It Out

Ever found yourself scratching your head over tax forms? We’ve all been there. Let’s dive into the W-9 form—a must-know document in the tax world that’s essential but often misunderstood. Whether you’re running a business or doing your own thing as a freelancer, this form has probably popped up on your radar. Here’s a breakdown of all the need-to-know stuff about this form.

When it comes to tax documentation, the W-9 form stands out as a crucial piece of paperwork for many individuals and businesses in the United States. Whether you’re a freelancer, independent contractor, or business owner, the W-9 form is essential for maintaining compliance with Internal Revenue Service (IRS) regulations and ensuring smooth financial transactions.

Key takeaways:

- Completing the W-9 form accurately involves entering the correct Taxpayer Identification Number (TIN), legal name, and tax classification.

- Common mistakes on W-9 forms include using incorrect names, mixing personal and business information, and forgetting to sign and date the form.

- W-9 forms should be submitted when starting new business relationships, opening financial accounts, or upon request from paying entities.

- Keeping your W-9 information up-to-date and submitting the form only to legitimate businesses helps maintain proper tax compliance and protects against identity theft.

What is a W-9 Form, and Who Needs It?

The W-9 form, or “Request for Taxpayer Identification Number and Certification,” is a document for collecting information from individuals and entities for tax reporting purposes.

But who exactly needs to fill out this form? Let’s break it down:

1. Independent Contractors and Freelancers

If you provide services to businesses as an independent contractor or freelancer you’ll likely need to complete a W-9 form for each client you work with. Businesses use the information on this form to issue 1099s for tax reporting.

This includes professionals such as:

- Musicians/DJs

- Graphic designers

- Writers and editors

- Web developers

- Consultants

- Photographers or Videographers

Example: Sarah, a freelance graphic designer, takes on a project for a marketing agency. Before paying her, the agency requests a W-9 form to have her tax information on record.

2. Self-employed individuals

Self-employed individuals, including sole proprietors and single-member LLCs, often need to provide W-9 forms to their clients or customers.

Example: John, a sole proprietor running a home repair business, signs a contract with a property management company for regular maintenance services. The company requests a W-9 from John to report payments made to him.

3. Partnerships and LLC

Partnerships and multi-member LLCs may need to provide W-9 forms to clients or financial institutions they do business with.

Example: A law firm structured as a partnership provides legal services to a corporation. Before issuing payment, the corporation requests the firm’s W-9 to ensure accurate reporting of income.

4. Corporations (S-Corps and C-Corps)

While corporations are typically exempt from backup withholding, they may still be asked to provide a W-9 form in certain situations, such as:

- Opening a bank account

- Establishing a business relationship with a new client

5. Real Estate Transactions

Property sellers or rental property owners may need to provide a W-9 form to the settlement agent or property management company for IRS reporting purposes.

Example: Emma owns a rental property and hires a property management company to handle tenant affairs. The company requests a W-9 form from Emma to report rental income paid to her.

6. Financial Account Holders

Financial institutions often require a W-9 when opening a new account, such as a bank, brokerage, or investment account, to verify your Taxpayer Identification Number (TIN) for IRS reporting.

7. Vendors and suppliers

Businesses often request W-9 forms from their vendors and suppliers to have accurate information for issuing 1099 forms for payments made during the tax year.

Example: A restaurant purchases produce from a local farm. The restaurant owner asks the farm owner to complete a W-9 form to properly report payments made throughout the year.

How to Fill Out the W-9 Form

Here’s a straightforward process for filling out the W-9 Form:

Step 1: Name (Line 1)

Enter your legal name as shown on your income tax return.

- For individuals: Enter your first name, middle initial, and last name.

- For sole proprietors: Enter your individual name, not your business name.

- For single-member LLCs: Enter the owner’s name, not your LLC’s name.

Step 2: Business Name/Disregarded Entity Name (Line 2)

- For sole proprietors: Enter your business name or “doing business as” (DBA) name.

- For single-member LLCs: Enter the LLC’s name.

Leave this line blank if it doesn’t apply to you.

Step 3: Federal Tax Classification (Line 3)

Tick the appropriate box for your federal tax classification. Options include:

- Individual/Sole proprietor or Single-Member LLC

- C Corporation

- S Corporation

- Partnership

- Trust/Estate

- Limited Liability Company (LLC)

For LLCs, you’ll need to enter the tax classification (C, S, or P) in the space provided.

Step 4: Exemptions (Line 4)

This section is typically for businesses and not individuals. Enter any applicable exempt payee code and exemption from the FATCA reporting code. If you’re unsure, leave these fields blank.

Step 5: Address (Lines 5 and 6)

Enter your address, including street address, city, state, and ZIP code. This should be the address where you’ll receive tax-related correspondence.

Step 6: Account Number(s) (Line 7)

This field is optional. You may enter account numbers here if you have multiple accounts with the requester and want to identify specific accounts.

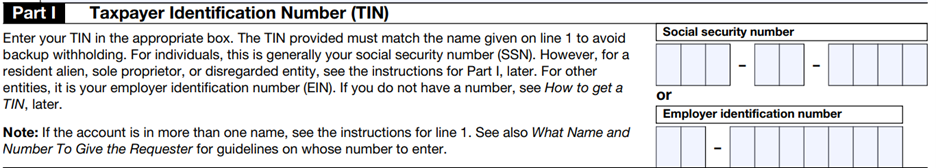

Step 7: Taxpayer Identification Number (TIN) (Part I)

Enter your TIN in the appropriate box. This will be either:

- Your Social Security Number (SSN) for individuals

- Your Employer Identification Number (EIN) for businesses

Use only one number – do not enter both an SSN and an EIN.

Step 8: Certification (Part II)

Read the certification statements carefully. By signing the form, you’re certifying that:

- The TIN you’re providing is correct

- You’re not subject to backup withholding

- You’re a U.S. citizen or other U.S. person

- The FATCA code(s) entered on the form (if any) are correct

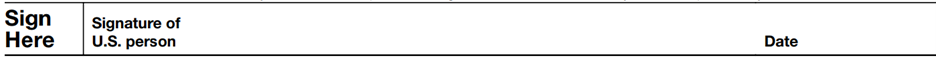

Step 9: Sign and Date

Sign and date the form. For electronic submissions, follow the requester’s instructions for digital signatures.

Common Mistakes to Avoid

When filling out a W-9 form, you need to be aware of potential pitfalls. Here are some common mistakes to avoid:

- Using the wrong name. Ensure you use your legal name as it appears on your tax return, not nicknames or abbreviated versions.

- Entering incorrect TIN. Double-check your SSN or EIN.

- Mixing personal and business information. If you’re a sole proprietor, make sure you’re using your personal name on Line 1 and your business name (if applicable) on Line 2.

- Forgetting to sign and date. An unsigned W-9 form is invalid. Always remember to sign and date the form.

- Providing outdated information. If your information changes (e.g., address or business structure), submit an updated W-9 form to all relevant parties.

- Overlooking exemption codes. If you qualify for exemptions, make sure to include the appropriate codes in Line 4.

- Using an old version. You must use the most current version of the W-9 form on the IRS website.

- Failing to check the correct tax classification. Make sure you select the appropriate box for your federal income tax classification in Line 3.

- Entering both SSN and EIN. Only enter one identification number – either your SSN or EIN, not both.

- Providing unnecessary information. Only fill out the required fields and those that apply to your situation.

Pro Tips:

- You should only provide a W-9 form to legitimate businesses or individuals with whom you have a professional relationship.

- Be cautious about unsolicited requests for W-9 forms, as they could be attempts at identity theft.

- Keep copies of all W-9 forms you submit for your records.

Team Up with ICONAC for Tax Simplicity

Taxes can feel as complex as music theory, but don’t let Form W-9 throw you offbeat! At ICONAC, we’re here to make sure your tax reporting hits the right notes—accurate, compliant, and hassle-free.

Here’s how ICONAC keeps things simple for you:

- Clear & Accurate Reporting

We help make sure your W-9 is accurate and IRS-approved, so you can avoid costly mistakes and keep things running smoothly. - Stress-Free Process

Don’t sweat the details—let us handle the tax forms while you focus on your music and creative projects. - Support Whenever You Need

Our support doesn’t stop with just filling out the form. We’re here to answer questions, help with updates, and keep you up-to-date on filing needs. - Big-Picture Tax Strategy

Your W-9 is just one part of the story. We can help make sure it aligns with your overall financial goals so that you’re not missing a beat. - Peace of Mind

Rest easy knowing your tax reporting is in good hands, freeing you to create without the worry of tax season stress.

Parting Thoughts

Though it may seem like just another form, the W-9 is essential. It connects the dots between you, the IRS, and accurate income reporting. Filling it out properly is the key to staying on top of your taxes, and with ICONAC, you’re never left wondering if it’s done right.

Ready to take the stress out of taxes? Reach out to ICONAC and take the first step towards mastering your Form W-9 and overall tax strategy.