As a musician, artist, or independent contractor, dealing with taxes can feel like trying to compose a symphony without knowing how to read music.

One important part of doing taxes involves understanding and properly filing 1099 forms. These play a vital role in reporting various income types to the Internal Revenue Service (IRS). Here’s a guide on how to file a Form 1099-NEC with ease, ensuring your career or business stays on the right side of tax regulations.

Even if you’re just starting your artistic journey, understanding how to handle these important tax documents is crucial for managing your finances.

In this post, we’ll help you understand what these forms are and walk you through the step-by-step process of filling them out and submitting them. This information is specifically tailored for the 2024 tax year to ensure accuracy and relevance.

Key Takeaways:

- Any individual who works as a freelancer or independent contractor should receive a 1099 form from each client who paid them more than $600 in a calendar year.

- Even if you don’t receive a 1099 form, you still need to report your income and pay the taxes you owe.

- 1099 forms can be filed by mail or electronically. Electronic filing is often the most secure and efficient method.

- The deadline for sending 1099s to taxpayers and the IRS is January 31, 2025 for the 2024 tax year.

Experience peace of mind with our seasoned tax professionals—contact us today!

What is the 1099 Form?

The 1099 form is a critical tool for reporting income to the IRS, serving as a way to document various types of income you’ve earned throughout the year. There are over 20 types of 1099 forms, each playing a unique role in reporting different kinds of income. Some of the most common ones for the musicians are:

- 1099-NEC (Nonemployee Compensation). If you’ve earned $600 or more from a single client for your artistic services, they are required to issue you this form.

- 1099-MISC (Miscellaneous Income). This form covers a range of income types, such as royalties exceeding $10, rental income, or prize winnings.

- 1099-K (Payment Card and Third-Party Network Transactions). If you sell your art, merch, or other goods through a third-party settlement organization (TPSO) like PayPal, Apple Pay, Venmo, or Zelle, this form may be issued to you if you have received more than $5,000 in total payments in 2024.

- Other 1099 forms. There’s a whole ensemble of other 1099 forms for various types of income, from interest (1099-INT) to dividends (1099-DIV) to proceeds from real estate transactions (1099-S).

Who Needs to File a 1099NEC?

You’ll typically need to file 1099-NEC forms if:

- You’re a business or individual who has paid $600 or more to an independent contractor or freelancer for business services in a calendar year.

For artists and musicians, this often applies when you’re hired for gigs, commissioned for artwork, or receive royalties for your creations. While the responsibility to issue 1099 forms lies with the payer, you’re responsible for ensuring the income is reported on your tax return.

Step-By-Step Guide For Filing A 1099-NEC Form

Step 1: Gather Necessary Information for 1099-NEC Filing

Before filling out forms, you need to gather all the necessary information and tools.

Required Information

To accurately complete the 1099 forms, you’ll need:

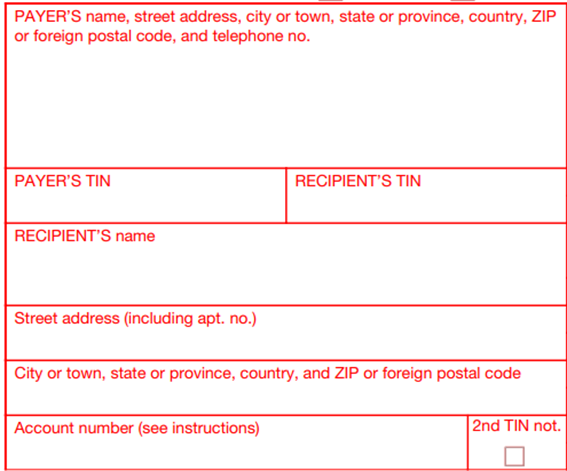

- Your business information – Legal name, address, and Employer Identification Number (EIN) or Social Security Number (SSN) if you don’t have an EIN.

- Recipient information – Their legal name, address, and Taxpayer Identification Number (TIN) or SSN. You can find this information from the recipient’s W-9 form.

- Payment records – Detailed records of all payments made to each recipient throughout the year.

Pro tip: Always keep payment records throughout the year. It’s much easier than trying to piece together a year’s worth of transactions come tax time.

Form Acquisition

You can’t file without the proper forms. Here’s where you can get them:

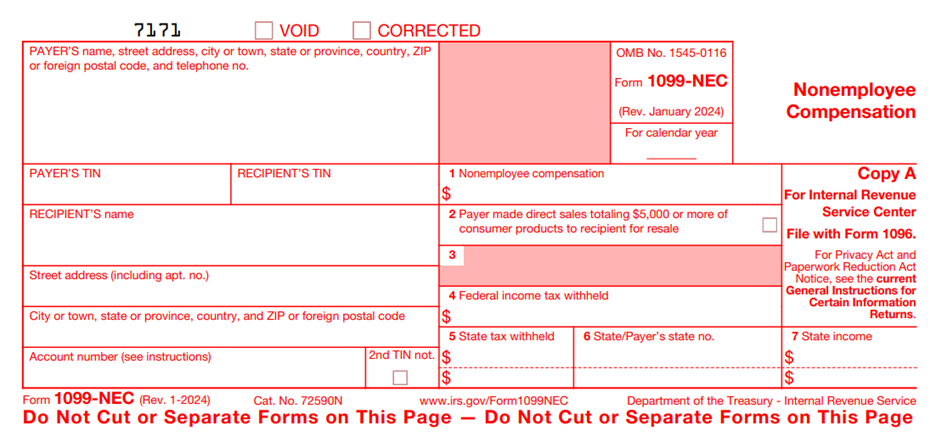

- IRS website. You can download and print some forms, but Copy A (the red-scannable copy you send to the IRS) must be ordered from the IRS or obtained from an approved vendor. The IRS doesn’t accept printed or photocopied versions of Copy A for paper filing.

- Office supply stores. Many carry official 1099 forms.

- Tax preparation software such as Tax1099. Electronic filing is strongly recommended, as it is often faster, reduces the risk of errors, and required if you’re submitting 10 or more 1099s in a year. Most tax software will generate and file the required forms for you, eliminating the need to purchase physical forms.

Understanding Form Variation

Make sure you’re using the right form for the right type of payment. Various 1099 forms have specific purposes, such as:

- 1099-NEC. Use this for reporting payments to independent contractors or freelancers totaling $600 or more in a calendar year.

- 1099-MISC. Use this a variety of payments, including royalties (over $10), rent, prizes, awards, and other miscellaneous income not reported on other 1099 forms.

- 1099-K. Use this to report payment card transactions and payments made through TPSO, such as Venmo or PayPal, for gross payment transactions totaling $5,000 or more in a calendar year.

Step 2: Complete 1099-NEC Form

General Information

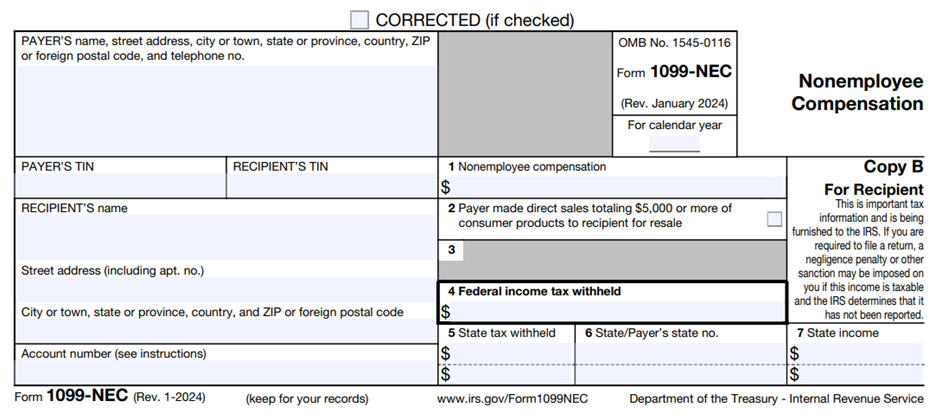

Start with the basic details:

- Payer’s information: Enter your business name, address, and TIN in the designated fields.

- Recipient’s information: Fill in the contractor’s name, address, and TIN.

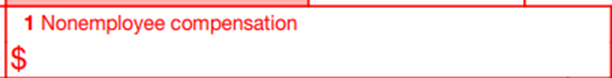

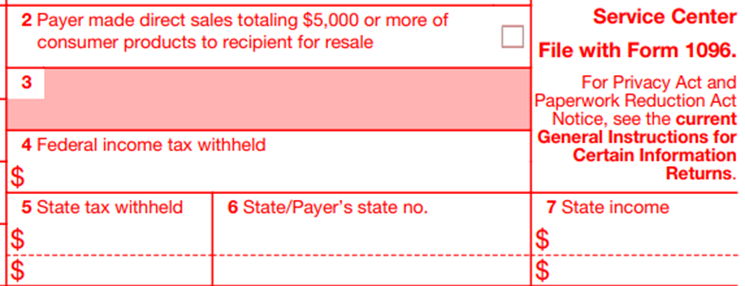

Payment Details.

This is where you detail the payments made:

- Box 1 (for 1099-NEC). Enter the total amount paid to the contractor during the year.

- Other boxes. Depending on the form and type of payment, you may need to fill out additional boxes for things such as withheld taxes.

Step 3: Verify Information

Before finalizing, take a moment to review everything:

- Double-check all numbers and spellings.

- Ensure you’ve used the correct form for the type of payment.

- Verify that the total amount matches your records.

Step 4: File Your 1099 Forms

With your forms filled out, it’s time to file with the IRS and distribute copies to your recipients. For most artists and musicians, electronic filing is often the simpler and more efficient choice, especially if you’re dealing with multiple forms.

If you are filing 10 or more 1009 forms, you must file electronically:

1. You can file directly through the IRS FIRE (Filing Information Returns Electronically) system.

2. Use a third-party tax filing software such as Quickbooks or Tax1099.

For paper filing:

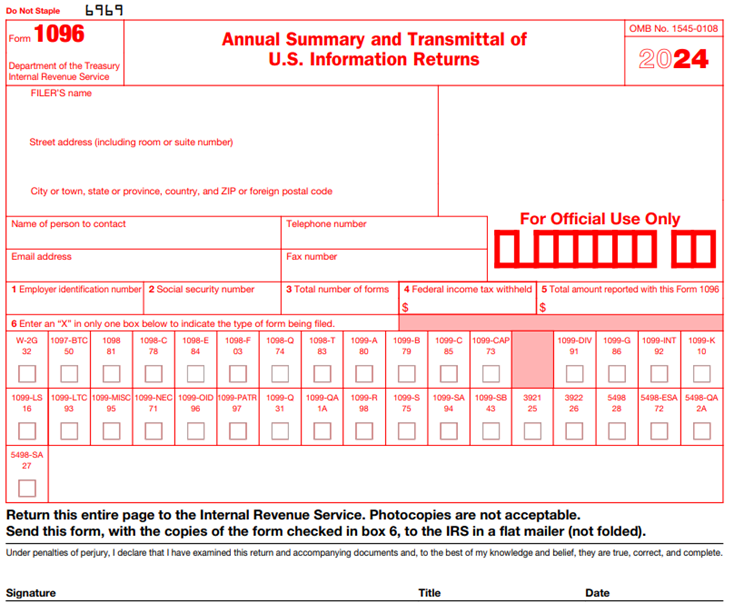

If you choose to paper file, make sure to include Form 1096 (Annual Summary and Transmittal of U.S. Information Returns). This form summarizes and transmits the accompanying paper Forms 1099 to IRS. Mail Copy A of each 1099 form to the IRS.

Step 5: Distribute Copies to Recipients

Don’t forget to send Copy B of the 1099 form to each recipient by January 31. This is crucial for them to report their income accurately.

Handling Corrections and Special Situations

Even the best performers sometimes hit a wrong note. Here’s how to handle corrections and special situations:

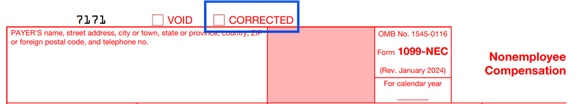

Correcting Errors

If you discover an error after filing:

1. Prepare a new, corrected form.

2. At the top of the form, mark or tick the “CORRECTED” box.

3. File the corrected form with the IRS and send a copy to the recipient

Late payments: If you make a payment after December 31, it should be reported in the next tax year’s 1099-NEC, not the current year. If you forgot to report a payment from the prior year, you may need to file a corrected 1099-NEC.

Foreign contractors: If the contractor is a non-U.S. resident and the work is done in the U.S., tax withholding may apply, and a 1042-S may be required.

Multiple payments under $600. Even if individual payments are under $600, if they total over $600 for the year, you still need to file a 1099.

Tips for Artists and Musicians

As creative professionals, you have unique considerations when it comes to 1099 forms:

Income Management

- Keep a detailed log of all your performances, sales, and commissions.

- Use accounting software designed for freelancers to easily track income from multiple sources, or hire a bookkeeper to do this for you.

- Open a separate bank account for your artistic income to simplify record-keeping.

Handling royalty payments

- If you receive royalties for your music or artwork:

- These are typically reported on Form 1099-MISC.

- Keep detailed records of all royalty payments, including the source and amount.

Be aware that different types of royalties (e.g., music streaming vs. licensing) may be reported differently.

Working with other artists

- Clarify who is responsible for issuing 1099 forms if payments are involved.

- Keep clear records of income splits and expenses for joint projects.

Managing multiple income streams

As a successful artist, you might have income from various sources:

- Performances

- Merchandise sales

- Teaching or workshops

- Licensing and royalties

Each of these may be reported differently, so organization is key.

Deadlines

Knowing the deadlines for filing 1099 forms is essential for staying compliant and avoiding penalties.

- Recipient Copies: Most 1099 forms must be provided to recipients by January 31st of the year following the tax year being reported.

- Paper Filing: If you’re submitting paper forms to the IRS, the deadline is typically February 28th.

- Electronic Filing: For electronic submissions, the deadline is usually March 31st.

Final Words

Filing 1099 forms might not be as exciting as releasing a new album or showcasing your latest artwork, but it’s a crucial part of your career as an artist or musician. Understand the process and stay organized. That way, you can turn this potentially stressful task into a well-orchestrated performance.

Remember, the key to success with 1099 forms is preparation and attention to detail. Keep accurate records throughout the year. Understand which tax forms apply to your situation. Don’t hesitate to seek professional help if you need it. Stay informed about all the changes in tax laws. Work with a business management firm with tax experts now. Here at ICONAC, we understand the unique needs of artists and musicians