The W-8BEN form helps non-U.S. residents claim tax benefits and reduce withholding on U.S. income. This guide covers the form’s purpose, eligibility, and completion instructions for U.S. tax compliance.

If you’re a non-U.S. resident earning money from the U.S., the W-8BEN form can help reduce the tax taken from your earnings. This guide explains the form’s purpose, who should use it, and tips for filling it out in a way that might help you keep more of your hard-earned cash!

Key Takeaways:

- The W-8BEN confirms your foreign status to the IRS (Internal Revenue Service).

- Skipping the form could mean up to 30% of your earnings withheld by the U.S.

- Tax treaties could lower or even erase this tax if your country has one with the U.S.

Why the W-8BEN Matters

If you’re earning money from U.S. sources, the IRS usually holds back 30% of your income unless you fill out the W-8BEN. This form is a way to show that you’re a non-U.S. resident and possibly eligible for lower tax rates if your country has a tax treaty with the United States. It’s a small step that could mean significant savings.

Even if you don’t pay U.S. taxes, you still need to submit the W-8BEN if you earn U.S.-based income from things like performance fees, royalties, dividends, or other payments. Without this form, the IRS assumes you owe the full 30% withholding tax on these earnings.

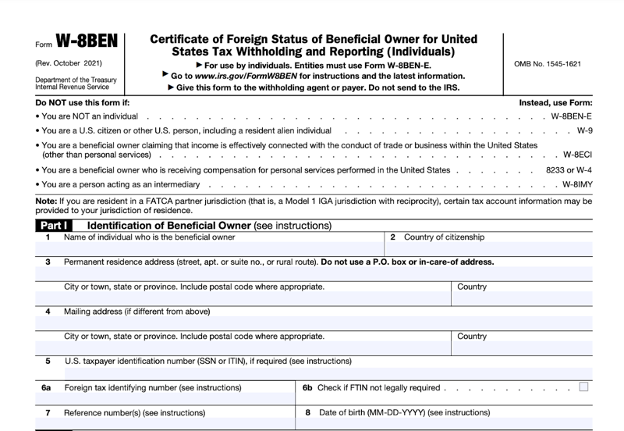

The W-8BEN Form: What’s It For?

The W-8BEN form, officially named “Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding,” is designed to tell the IRS that you’re not a U.S. resident and might qualify for a tax treaty benefit.

The form’s main purposes are:

- To confirm you’re the true recipient (beneficial owner) of U.S.-based income.

- To verify you’re a foreign individual, or non-U.S. resident so that U.S. withholding rules apply fairly to your earnings.

- To claim a reduced tax rate, if there’s an income tax treaty between the U.S. and your home country.

Without the W-8BEN, U.S. law requires a default 30% withholding on many types of payments to non-U.S. citizens. Filing the form gives you a way to prove your foreign status and take advantage of any applicable tax treaty benefits.

Breakdown of Key Sections in the W-8BEN Form

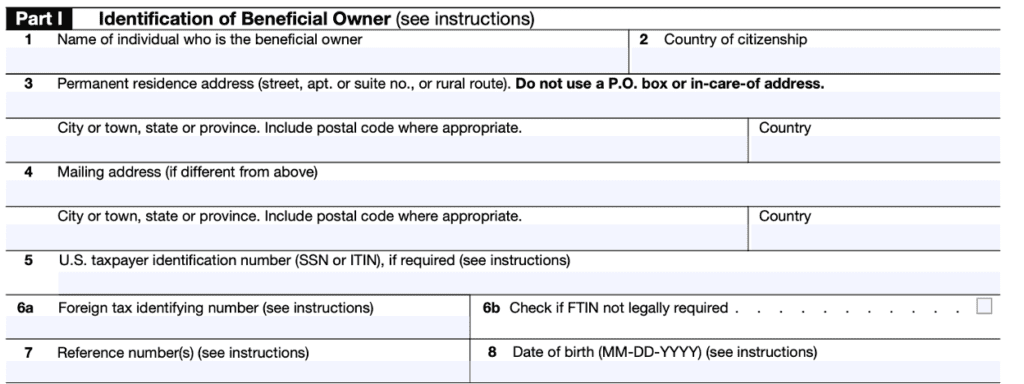

Part I: Identification of Beneficial Owner

Click on this link to download the current W-8BEN form.

This section asks for basic personal information about you, the recipient of the income. Enter the following carefully to avoid errors:

- Line 1: Your full legal name, as it appears on your official documents (like a passport).

- Line 2: Your country of citizenship, which helps confirm if you’re eligible for treaty benefits.

- Line 3: Your permanent address.

- Line 4: Mailing address (if different from your permanent address).

- Line 5: Your U.S. Taxpayer Identification Number (if you have one).

- Line 6: Your foreign tax ID number (if applicable).

- Line 8: Your date of birth (in the format requested).

Part II: Claim of Tax Treaty Benefits

If your country has an income tax treaty with the U.S., this is where you claim it:

- Line 9: Enter the name of your country

- Line 10: Specify the treaty article and paragraph number that apply to your income type, and describe the income (e.g., “dividends” or “royalties”).

Completing this section allows you to take advantage of any tax benefits or lower rates your country’s treaty with the U.S. may offer.

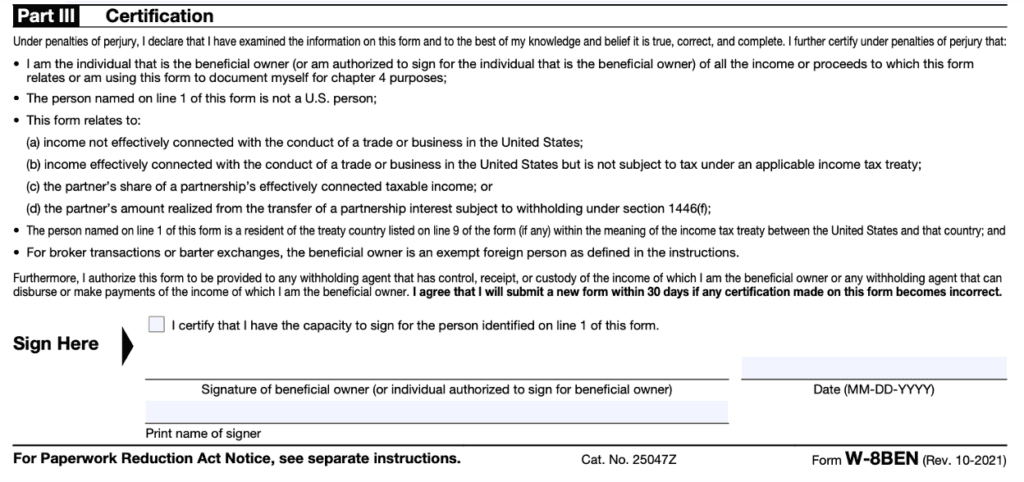

Part III: Certification

This is where you sign to certify that the information provided is true. It’s a legal statement confirming everything in the form is accurate. An electronic signature is acceptable as long as it meets the necessary requirements, like a timestamp. Sign and date the form on the day you complete it.

Tip: Double-check the details you provide here to prevent issues with your tax benefits. This section is about certifying the information you provided in the previous parts of the form. It declares that the information is true, correct, and complete.

Where to Submit the Form W-8BEN

Once your W-8BEN is filled out, don’t send it to the IRS. Instead, give it to the “withholding agent” (the company or person paying you). Submitting it before you’re paid is important since, without it, your withholding agent might have to hold back 30% by default.

If you share income with someone else (like in a joint account), both of you need to submit a W-8BEN to avoid being taxed as if you’re a U.S. resident. And remember to update the form if any of your details change—such as your address or citizenship—to ensure you keep your tax benefits.

When Should You File the W-8BEN Form?

If you’re a non-U.S. resident earning income from a U.S. source (like royalties, dividends, or performance fees), filing this form can prevent you from paying more tax than necessary. Not every non-U.S. person needs it, but it’s essential if you’re earning U.S.-based income that could be taxed.

Typical income sources that might require the W-8BEN include:

- Compensation for services performed in the U.S.

- Royalties and dividends

- Interest and original issue discount (OID)

- Rents and annuities

With a correctly filled-out W-8BEN, each type of income listed above might qualify for a reduced tax rate, depending on the tax treaty between the U.S. and your home country.

Note: U.S. citizens should use forms like W-9 or W-4 instead.

Common Mistakes and How to Avoid Them

Filling out the W-8BEN can be confusing, and mistakes might delay processing or lead to higher withholding. Here are some common pitfalls to watch out for:

- Incorrect TIN or SSN: Double-check these numbers before you submit.

- Incomplete sections: Make sure every part is complete and accurate.

- Name and TIN mismatch: Use the same name as on other tax documents.

- Mistaken residency status: Double-check your residency to ensure you’re filing correctly.

If you need help, this guide can help you or reach out to ICONAC!

When to Consult a Tax Professional

Sometimes, filing the W-8BEN is straightforward. But if you have multiple income sources, split time between countries, or complex investments, talking to a tax expert can be helpful. They can help you maximize your tax savings and ensure you’re fully compliant with U.S. tax rules.

A professional can assist with:

- Tax Recovery: Helping you recover overpaid U.S. taxes.

- Form Preparation: Ensuring your W-8BEN is correctly filled out.

- Tax Planning: Offering strategies to reduce tax liabilities and increase refunds.

Final Thoughts

Don’t let the form W-8BEN intimidate you! This guide covers the basics, but if you’re still unsure, a tax expert can help you complete it accurately. Remember, don’t send this form directly to the IRS—submit it to the person or organization paying you instead.

Ready to simplify your U.S. tax filings? Reach out to ICONAC for tailored guidance so you can focus on growing your income without stressing over taxes!

Your tax peace of mind starts here—get in touch for W-8BEN assistance!