How To Fill Out W-8BEN Tax Form: A Step-by-Step Tutorial

Non-U.S. residents use the W-8BEN tax form to certify their foreign status and claim any applicable tax treaty benefits. Learn how to fill out the W-8BEN tax form below.

If you’re a musician from outside the U.S. and earn money from U.S. sources—such as royalties, performance fees, or music streaming income—you’ll likely need to complete a W-8BEN form.

This form certifies that you’re a foreign resident, so you can pay a fair tax rate on your U.S. earnings instead of the higher default rate. It utilizes the full benefits available under a tax treaty. If completed properly, this form will help you avoid useless headaches and keep you in compliance with U.S. tax laws.

Here’s a simple, step-by-step guide to help you fill out the W-8BEN form without getting bogged down in tax jargon.

Key Takeaways:

- Learn how you will report your individual and tax information to confirm your foreign status and withhold your taxes.

- Understand how to use the form to claim any tax treaty benefits.

- Note common mistakes to avoid so that your form may be complete and accurate.

Avoid tax penalties and simplify your U.S. tax filing. Click here to get started on your W-8BEN form!

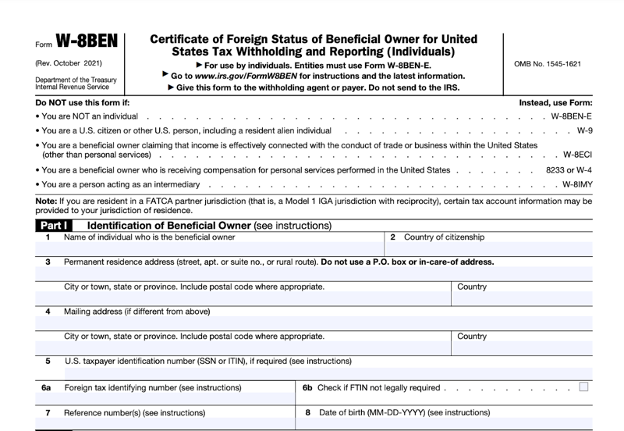

What Is a W-8BEN Form?

The W-8BEN form, also called the “Certificate of Foreign Status,” is essential for non-U.S. residents who want to reduce their tax rate on U.S. earnings. Normally, without it, the IRS will withhold a flat 30% on your U.S. income (ouch!). But with a completed W-8BEN, you could qualify for a lower rate if your country has a tax treaty with the U.S.

The W-8BEN form is used by non-U.S. residents who earn certain types of income from U.S. sources. This includes freelancers, contractors, investors, or anyone receiving income such as:

- Compensation for services performed

- Interest

- Annuities

- Dividends

- Premiums

- Royalties

Purpose of the W-8BEN Form for Non-U.S. Residents

You might need to fill out this form for the following reasons:

- Establish your foreign status. This confirms that you’re not a U.S. resident, which is important for applying the correct tax treatment to your income.

- Claim tax treaty benefits. If your country has a tax treaty with the U.S., you may be eligible for reduced withholding rates or exemptions on certain types of income.

- Minimize or avoid withholding tax. Without the W-8BEN, U.S. payers are required to withhold tax at the maximum rate, which perhaps is more than what you would otherwise owe.

The W-8BEN form is straightforward but requires attention to detail. It has three sections that collect information to confirm your foreign status and claim any tax treaty benefits, which can significantly reduce the U.S. taxes withheld from your payments.

Non-U.S. resident? Make filing your W-8BEN fast, accurate, and hassle-free – get started today!

Guide to Filling Out the W-8BEN Form

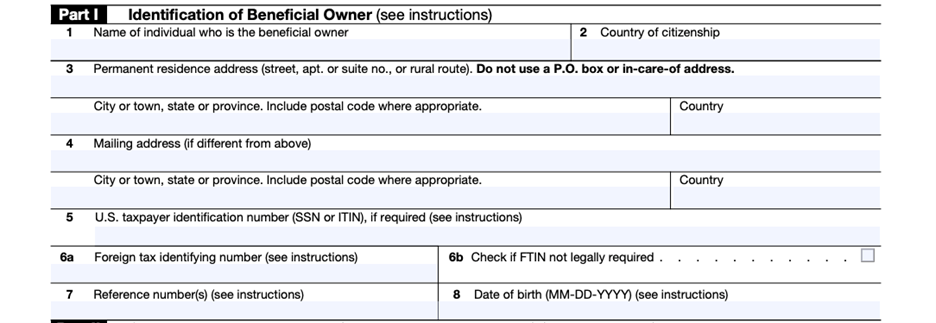

Part I: Identification of Beneficial Owner

In this part, you need to fill out all your personal information, including:

Name of Individual

Enter the full name of the beneficial owner. Use the name that matches your passport or other ID.

Country of Citizenship

Enter your country of citizenship. This helps the IRS confirm your non-U.S. resident status and apply the correct tax treaty benefits.

Permanent Address

Enter your permanent residence address if it’s outside the U.S. Use your country’s format for the address, including city, state or province, and postal code. This address helps the IRS confirm your foreign status and ensure accurate correspondence.

Mailing Address (if different)

If your permanent address differs from your mailing address, enter it here. If both addresses are the same, leave this line blank. Providing a separate mailing address ensures the IRS can send documentation to the correct location.

Foreign Tax Identifying Number

Enter your foreign tax identification number if you have one. A foreign TIN is generally required if you’re claiming a reduced rate of withholding under a tax treaty,

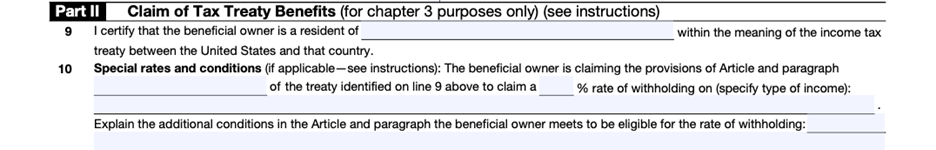

Part II: Claim of Tax Treaty Benefits

Part II of the W-8BEN form is used to claim benefits under an income tax treaty. In this section, specify the basis for the reduced withholding tax on U.S.-sourced income.

Claim of Tax Treaty Benefits

If there’s a tax treaty between the U.S. and your home country, you can claim the benefits here. You will be required to identify your country and also specify the article of the tax treaty that might apply in your particular case.

If you qualify for reduced withholding tax rates on certain income, refer to the relevant article in your country’s tax treaty. You can find this article and claim benefits by reviewing the treaty document.

Special Rates and Conditions

Describe any special rates or conditions for specific types of income under your country’s tax treaty. For example, if there’s a reduced withholding rate for dividends or interest, outline those details here. This will help your withholding agent ensure the correct amount is withheld from your U.S. income.

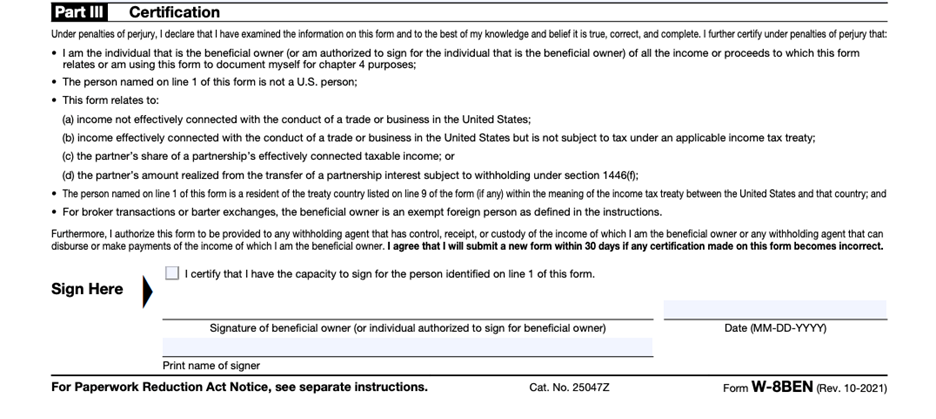

Part III: Certification

Signature and Date

The bottom of the form requires a signature and date to affirm all the information provided.

Make your signature match your legal name, as filled on the form. Use the right date format, MM/DD/YYYY. Your signature shows that you have gone through the form and are aware of its contents, and everything on it is correct.

Bonus Tips: If you are unsure about anything on this form or how to apply for tax treaty benefits, consult a tax professional. Experts like ICONAC have experience in international taxation matters.

Submitting the W-8BEN Form

Learn more about where, how, and what mistakes to avoid when filing the W-8BEN form.

Where to submit the form

After you’ve filled out your W-8BEN form, just send it to your “withholding agent“—the person or organization paying you (like a company or venue). This agent handles any tax withholding on your U.S. income, like performance fees or royalties. They’ll handle the necessary tax withholdings and report to the Internal Revenue Service (IRS) for you.

Just keep in mind—the IRS doesn’t receive W-8BEN forms directly from you.

What to expect after filing the form

Upon submitting the W-8BEN, your withholding agent will determine your status’s reduced tax rate and apply it, as stated in the form. Note that this will be applied only to prospective payments.

Properly filling out and submitting form W-8BEN means that the exact amount of U.S. tax withheld will be held against your income. In the event of failure to file the form, the 30% tax rate shall, by default, apply.

Mistakes to Avoid When Filling W-8BEN Form

The most frequent errors to avoid in filing the W-8BEN form are:

- Incomplete or incorrect information. Verify personal and tax details carefully. Mistakes like misspelled names, inaccurate TINs, or incorrect citizenship can cause issues.

- Blank space. Fill out all relevant sections, especially if claiming tax treaty benefits, to avoid delays or rejection.

- Misunderstanding tax treaty benefits. Claiming tax treaty benefits can be complex, so consult the treaty between your country and the U.S.

FAQs About W-8BEN Tax Form

Do I need a new W-8BEN form every year?

No. Generally, Form W-8BEN will be effective for determining foreign status for a 3-year period. It begins on the date the form is signed and ends on the last day of the third calendar year (unless a change in circumstances makes any of the information provided on the form incorrect).

How do I find out if my country has a tax treaty with the U.S.?

You can go ahead and verify whether your country has entered into a tax treaty with the U.S. by visiting the IRS’s official website. This is where you will find the complete list of countries that have active tax treaties and their benefits. You can also consult the document on the tax treaty itself.

What if I don’t have an SSN?

If you don’t have an SSN, you can still complete Form W-8BEN. We can assist you in applying for one, and once you receive your SSN, you can update your W-8BEN form accordingly.

Wrap-Up

Filling out the W-8BEN might seem intimidating, but by following these steps and double-checking your information, you’ll be able to claim any tax benefits you’re eligible for and make sure you aren’t overpaying. Whether you’re touring, streaming, or distributing music in the U.S., this form is key to keeping more of your income in your pocket!

Looking for more guidance? Reach out to ICONAC to ensure the submission’s accuracy. We can help you maximize your benefits and avoid any issues along the way.

Save time and eliminate guesswork – complete your W-8BEN tax form with our expert assistance!